Furniture Manufacturing Comparison Tool

Compare Furniture Manufacturing Leaders

See how China, Vietnam, and India stack up on production volume, growth, specialty materials, and key advantages. All data reflects 2024 figures from the article.

China: The Global Giant

$180 billion production value (40% of global exports)

Vietnam: The Rising Star

$14.5 billion exports (600% growth since 2015)

India: The Craftsmanship Leader

$6.8 billion exports (18% growth since 2023)

Key Insights

China dominates volume but faces competition from Vietnam and India. Vietnam is the top source for US furniture, while India excels in artisan craftsmanship with eco-friendly materials.

Did you know? Vietnam's furniture exports to the US grew from $2B in 2015 to $7B in 2024 alone.

When you buy a sofa, a wooden dining table, or a bed frame, chances are it didn’t come from your local store’s backroom. Most of the furniture in homes across the U.S., Europe, and even parts of Asia is made in just a handful of countries. These places don’t just assemble pieces-they build entire supply chains, train skilled workers, and export millions of items every year. So which countries lead the pack in furniture manufacturing today? The answer isn’t just about scale-it’s about cost, craftsmanship, and logistics working together.

China: The Giant of Global Furniture Production

China still makes more furniture than any other country in the world. In 2024, it produced over $180 billion worth of furniture, accounting for nearly 40% of global exports. That’s more than the next four countries combined. Factories in Guangdong, Zhejiang, and Fujian provinces churn out everything from mass-market particleboard bookshelves to hand-carved mahogany sets. What keeps China on top? Cheap labor, massive scale, and decades of investment in logistics. A single port in Shenzhen can ship out 2,000 containers of furniture in a week.

But it’s not just about volume. Chinese manufacturers now produce higher-end pieces too. Many European brands source their premium lines from China because the quality has improved dramatically since the 2010s. Today, you’ll find Chinese-made furniture with FSC-certified wood, water-based finishes, and modular designs that meet strict EU safety standards. The shift isn’t about cutting corners anymore-it’s about precision.

Vietnam: The Fastest-Growing Furniture Powerhouse

If China is the giant, Vietnam is the rising star. Furniture exports from Vietnam hit $14.5 billion in 2024, up from just $2 billion in 2015. That’s a 600% increase in less than a decade. Why? Because companies are moving production out of China. Rising wages, trade tensions, and supply chain risks pushed brands like IKEA, Ashley Furniture, and Wayfair to look elsewhere. Vietnam became the natural choice.

Vietnam’s advantages are clear: lower labor costs than China, strong trade deals with the U.S. and EU, and a growing base of skilled woodworkers. The country has over 2,000 furniture factories, mostly clustered in the south around Ho Chi Minh City and Dong Nai Province. Many of these factories are owned or partnered with foreign investors, bringing in modern machinery and quality control systems.

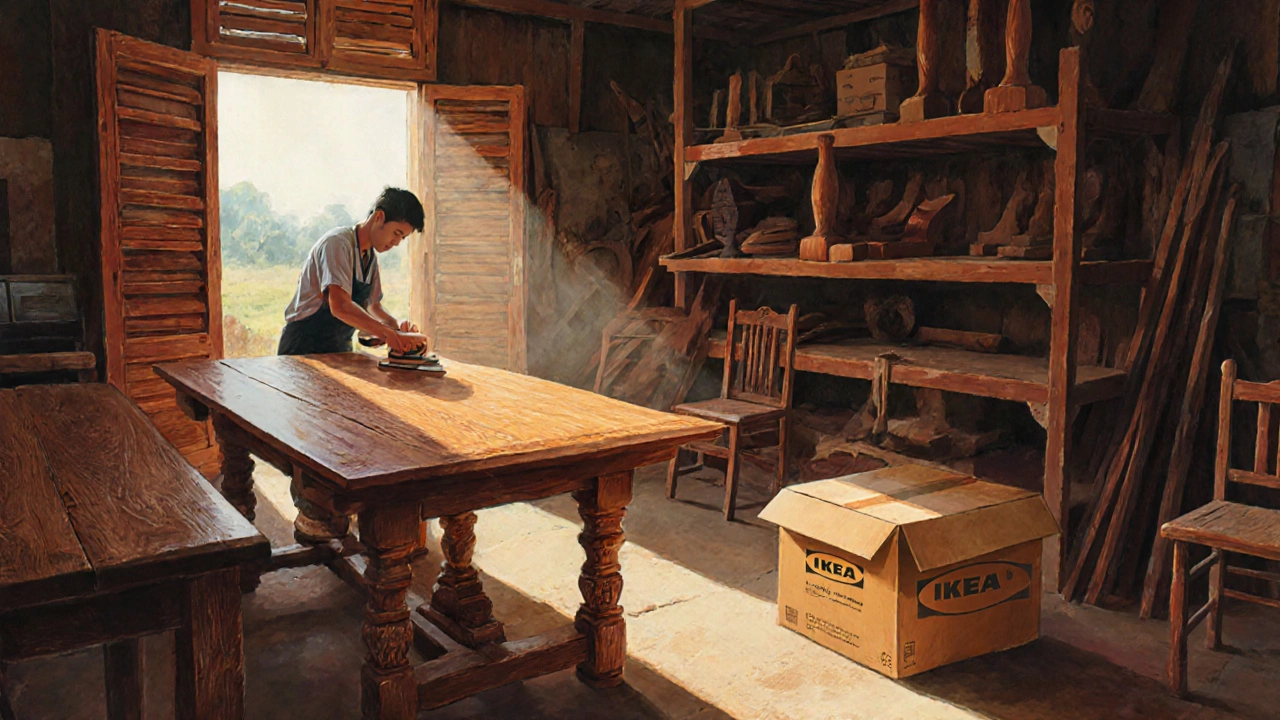

What sets Vietnam apart is its focus on solid wood. While China still dominates in engineered wood, Vietnam specializes in teak, oak, and acacia-materials that last decades. Their furniture often carries a natural, hand-finished look that’s popular in North American and Scandinavian markets. In 2024, the U.S. imported more than $7 billion worth of Vietnamese furniture-making it the top source for American households.

India: The Quiet Contender with Massive Potential

India doesn’t always show up on the top lists, but it’s quietly becoming one of the most important players. In 2024, India exported over $6.8 billion in furniture, up 18% from the year before. That’s not as much as China or Vietnam, but the growth rate is among the highest in the world. And here’s the key: India is building its own domestic market at the same time.

Mumbai, Delhi, and Ludhiana are home to thousands of small workshops and medium-sized factories producing everything from carved teak wardrobes to modern metal-and-wood dining sets. Unlike China, where automation dominates, India still relies heavily on skilled artisans. A single traditional chowk (carved wooden bed) can take three craftsmen over a month to complete. That craftsmanship is what makes Indian furniture valuable in niche markets.

The Indian government’s Production Linked Incentive (PLI) scheme for furniture and home goods has added fuel to this growth. Since 2022, over $1.2 billion in incentives have been distributed to manufacturers who export or scale up production. Exporters now benefit from lower taxes, better access to ports like Mundra and Nhava Sheva, and improved logistics partnerships with companies like Blue Dart and Delhivery.

India’s biggest advantage? Raw materials. The country produces more than 10 million cubic meters of timber annually, including teak, sheesham, and mango wood. Unlike Vietnam, which imports much of its hardwood, India is largely self-sufficient. Plus, Indian designs blend traditional motifs with minimalist trends-something that appeals to younger buyers in Europe and North America.

Why These Three Dominate

It’s not random that these three countries lead. Each has a unique combination of factors:

- China: Scale, infrastructure, and supply chain control. It’s the factory floor of the world.

- Vietnam: Trade-friendly policies, rising quality, and a focus on solid wood. It’s the new reliable partner.

- India: Artisan skills, abundant raw materials, and fast-growing domestic demand. It’s the hidden gem with long-term potential.

Other countries like Poland, Italy, and Germany make high-end furniture, but they don’t compete on volume. Their products are luxury items, priced at $2,000+ per piece. The top three countries? They make the everyday furniture that fills homes, dorm rooms, and rental apartments across the globe.

What’s Next for Furniture Manufacturing?

The next five years will see even more change. Automation is creeping into Indian and Vietnamese factories. In China, companies are shifting from low-cost mass production to smart manufacturing-using AI to predict demand and reduce waste. Sustainability is becoming non-negotiable. Buyers now ask: Is the wood certified? Are the glues non-toxic? Was this made in a factory with fair wages?

India’s biggest opportunity? Becoming the go-to source for eco-friendly, handcrafted furniture. Vietnam will keep growing as a mid-range exporter. China will stay dominant but face more competition from Southeast Asia. The global furniture map is changing, and the winners aren’t just the biggest-they’re the most adaptable.

Where Does Your Furniture Really Come From?

Next time you buy a new piece, check the label. You might be surprised. A table labeled "Made in Vietnam" might have wood sourced from Laos, assembled in Ho Chi Minh City, and shipped from the Port of Hai Phong. A bed frame labeled "Made in India" could use mango wood from Uttar Pradesh, painted in a factory near Jaipur, and packed in Mumbai for export.

Understanding where furniture comes from isn’t just about geography-it’s about recognizing the people, skills, and systems behind it. The top three countries aren’t just producing furniture. They’re building economies, creating jobs, and shaping global design trends-one table, one chair, one bed at a time.

Which country exports the most furniture in the world?

China exports the most furniture in the world, accounting for nearly 40% of global shipments. In 2024, its furniture exports reached $180 billion, far ahead of any other country. Its dominance comes from massive production capacity, low labor costs, and decades of investment in logistics and supply chains.

Is Vietnam now bigger than China in furniture manufacturing?

No, Vietnam is not bigger than China in overall production, but it’s the fastest-growing major exporter. Vietnam exported $14.5 billion in furniture in 2024, compared to China’s $180 billion. However, Vietnam is now the top source of furniture for the U.S. market, overtaking China in recent years due to trade policies and supply chain shifts.

Why is India becoming important in furniture manufacturing?

India is growing fast because of its skilled artisans, abundant supply of native woods like teak and sheesham, and strong government support through the PLI scheme. In 2024, India exported $6.8 billion in furniture, up 18% from the previous year. Its focus on handcrafted, sustainable pieces is attracting buyers who want unique, eco-friendly alternatives to mass-produced imports.

What type of furniture does Vietnam specialize in?

Vietnam specializes in solid wood furniture-especially teak, oak, and acacia. Its products often feature clean, modern designs with hand-finished details. Unlike China, which produces a lot of particleboard and MDF furniture, Vietnam focuses on durable, long-lasting pieces that appeal to North American and European consumers looking for quality over quantity.

Are Chinese-made furniture products still low quality?

No, that stereotype is outdated. While China still produces budget furniture, many factories now make high-quality, premium pieces for global brands. Factories in Guangdong and Zhejiang use FSC-certified wood, water-based finishes, and automated quality control. Brands like IKEA and Herman Miller source their best-selling lines from China because the craftsmanship now meets international standards.

Can India compete with China on price?

India can’t match China’s price on basic, mass-produced items like flat-pack shelves or particleboard desks. But it can compete on handcrafted, solid wood furniture where labor and design add value. Indian furniture often costs 10-20% more than Chinese equivalents, but buyers pay more for durability, unique designs, and sustainable materials.