Steel Industry Job Impact Calculator

Job Impact Calculator

Estimate potential job impacts based on different acquisition scenarios for U.S. Steel. The calculator uses data from the article to provide realistic projections.

Estimated Job Impact

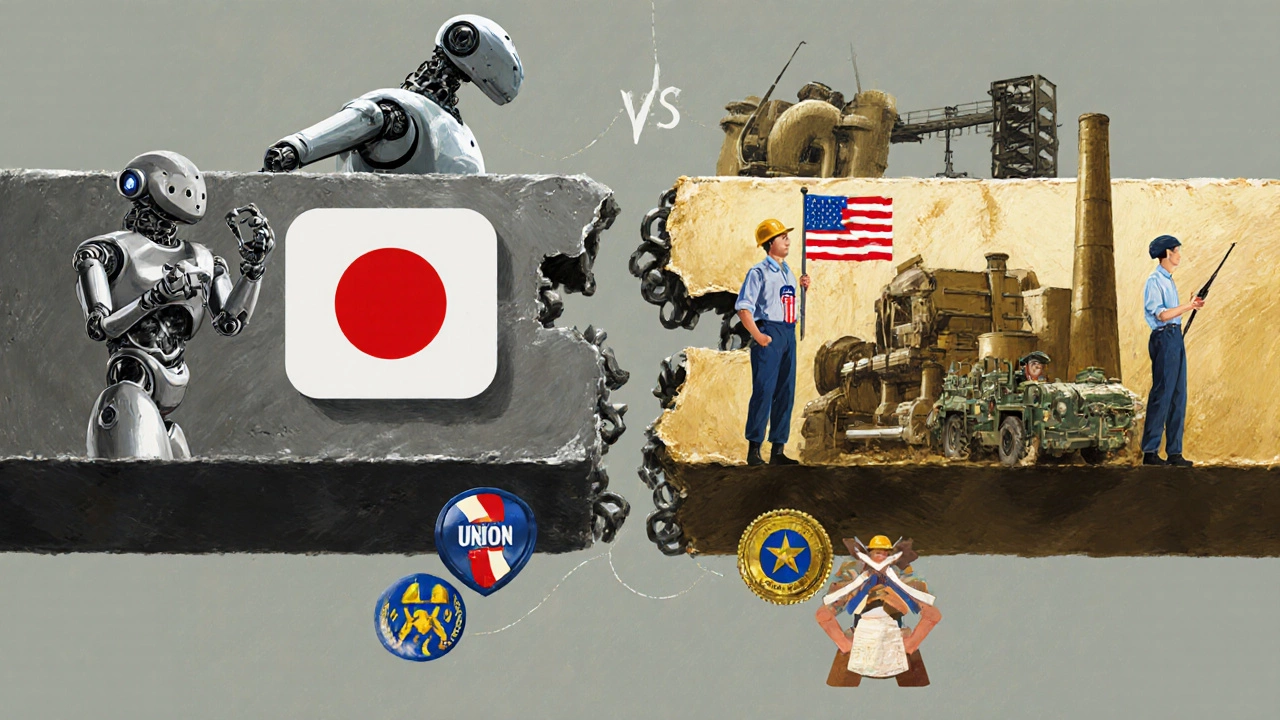

U.S. Steel, one of America’s oldest and largest steelmakers, has become the center of a high-stakes corporate battle. In early 2025, Nippon Steel, Japan’s biggest steel producer, made a formal offer to buy the entire company for $30 billion. This isn’t just another merger-it’s a move that could reshape global steel supply chains, affect thousands of American jobs, and spark political debate over national security and industrial sovereignty.

Why Nippon Steel Wants U.S. Steel

Nippon Steel doesn’t need U.S. Steel because it’s struggling. In fact, it’s one of the most efficient steel producers in the world, with annual production of over 40 million tons. But it’s missing something critical: a strong foothold in North America. The U.S. market is the largest single consumer of steel in the world, buying more than 90 million tons annually. Most of that steel still comes from domestic mills, but tariffs and supply chain risks have made foreign producers eager to own production inside the border.

U.S. Steel operates 11 major plants across the U.S., including the massive Gary Works in Indiana-the largest integrated steel mill in North America. It also has a network of mini-mills, coke plants, and distribution centers. For Nippon Steel, buying U.S. Steel means instant access to U.S. customers, reduced shipping costs, and the ability to bypass U.S. import tariffs that currently hit Japanese steel at 25%.

More than that, U.S. Steel produces high-quality flat-rolled steel used in cars, appliances, and construction. Nippon Steel already supplies steel to Toyota, Honda, and Ford. Owning U.S. Steel would let it directly serve these automakers without relying on third-party distributors or facing political headwinds.

The Political Firestorm

The bid hasn’t been met with open arms. President Joe Biden’s administration has signaled strong opposition. In a public statement in June 2025, White House National Economic Council Director Brian Deese called the deal “a threat to national security and economic resilience.” The concern isn’t just about losing a major U.S. manufacturer-it’s about control over critical infrastructure.

Steel isn’t just for beams and cars. It’s used in military vehicles, pipelines, power plants, and defense equipment. The U.S. government relies on domestic steel producers to meet defense contracts under the Defense Production Act. If a foreign company owns U.S. Steel, who controls those supply lines? What happens if geopolitical tensions rise between the U.S. and Japan?

Senators from Pennsylvania, Ohio, and West Virginia-states with major U.S. Steel plants-have formed a bipartisan coalition to block the deal. They’re warning that Nippon Steel might shut down older, less efficient plants to cut costs, risking layoffs of over 15,000 workers. The United Steelworkers Union has launched a nationwide campaign, urging members and the public to pressure lawmakers.

What’s at Stake for Workers and Communities

U.S. Steel employs about 17,000 people directly and supports another 100,000 jobs through suppliers and local businesses. The company has been a pillar in towns like Clairton, Pennsylvania, and Granite City, Illinois, for over a century. Many workers have third-generation family members who worked in the same mills.

Nippon Steel says it plans to keep all plants open and invest $5 billion over five years in modernization. But past foreign takeovers in manufacturing don’t always match those promises. When ArcelorMittal bought Mittal Steel in 2006, it closed 14 U.S. plants within five years. When POSCO bought a U.S. steel distributor in 2017, it shifted production to Korea and cut local jobs.

Workers aren’t just worried about layoffs-they’re worried about culture. Nippon Steel’s management style is known for long hours, seniority-based promotions, and limited union influence. U.S. Steel workers, under a strong union contract, have negotiated wage increases, healthcare, and pension protections over decades. Can those be preserved under Japanese ownership?

Other Bidders and Alternatives

Nippon Steel isn’t the only one interested. In late 2024, Posco, South Korea’s top steelmaker, quietly explored a bid but pulled out after realizing the political risks were too high. Hyundai Steel also showed interest but lacked the capital for a full takeover.

Some analysts believe U.S. Steel might be better off selling to a domestic buyer. Allegheny Technologies, a smaller but profitable specialty steel producer, has expressed interest in buying parts of the business. Steel Dynamics, based in Indiana, is another possible suitor. Both are U.S.-based, union-friendly, and already have modern facilities.

There’s also talk of a government-backed solution. The Biden administration has floated the idea of creating a national steel reserve fund-using federal loans or equity stakes to keep U.S. Steel under American control. The Treasury Department is evaluating options, but no formal proposal has been made yet.

Global Context: Why This Matters Beyond the U.S.

This isn’t just an American story. The global steel industry is in the middle of a massive realignment. China produces nearly half the world’s steel, but its output is slowing due to environmental rules and overcapacity. Europe is shifting to green steel made with hydrogen. India is expanding rapidly. Japan and South Korea are looking to secure raw materials and production capacity abroad.

For Japan, owning U.S. Steel means more than just market access-it’s a strategic hedge against supply disruptions. If a conflict in the Taiwan Strait disrupts shipping, or if U.S. tariffs on Chinese steel spike again, Nippon Steel needs a reliable, nearby source of high-quality steel. U.S. Steel’s location in the Midwest gives it access to Great Lakes iron ore and coal from Appalachia, making it one of the most cost-effective producers in the Western Hemisphere.

Meanwhile, the EU has already blocked two Chinese steel acquisitions in the past five years. Canada rejected a Chinese bid for a steel plant in 2023. The U.S. is now following the same logic: critical industries can’t be left to foreign control, especially when they’re tied to national defense.

What Happens Next?

The deal is now under review by the Committee on Foreign Investment in the United States (CFIUS). This interagency group, made up of officials from Defense, Treasury, Energy, and Homeland Security, has 45 days to decide whether to approve, block, or demand changes to the deal.

There are three likely outcomes:

- Approval with conditions: Nippon Steel keeps control but agrees to maintain minimum production levels, keep all plants open for 10 years, and allow union representation on its U.S. board.

- Blocked: CFIUS rejects the deal outright, citing national security risks. U.S. Steel remains independent, but may struggle to compete without foreign investment.

- Divided sale: Nippon Steel buys only the profitable flat-rolled division, while U.S. Steel sells its smaller mills to American buyers like Steel Dynamics or a private equity firm.

Analysts say the third option is the most realistic. It lets Nippon Steel get what it wants-access to the North American market-while giving the U.S. government a way to preserve jobs and local control.

What This Means for the Future of Steel

Regardless of the outcome, this battle signals a new era for American manufacturing. The days when U.S. companies could be bought by foreign giants without scrutiny are over. The U.S. government is now actively protecting its industrial base-not just for economic reasons, but for security.

It also shows how global supply chains are becoming more regional. Companies can no longer rely on cheap labor overseas and just ship products to the U.S. They need to own production where the customers are. That’s why Nippon Steel is willing to pay $30 billion-to avoid future tariffs, delays, and political risk.

For workers, the question isn’t just about their paycheck. It’s about legacy. U.S. Steel built the bridges, the skyscrapers, the tanks, and the cars that shaped modern America. If it’s sold to a foreign company, does that legacy live on-or does it become a footnote in a Japanese corporate report?

Is Nippon Steel still trying to buy U.S. Steel in 2025?

Yes, as of November 2025, Nippon Steel’s $30 billion bid for U.S. Steel is still active and under review by CFIUS. The deal has not been approved or rejected yet, but negotiations continue behind closed doors.

Why is the U.S. government opposing the sale?

The U.S. government fears losing control over a key supplier of steel used in defense, infrastructure, and energy projects. There are also concerns about job losses, union rights, and whether a foreign-owned company would prioritize profits over U.S. national interests.

What would happen to U.S. Steel workers if the deal goes through?

Nippon Steel has promised to keep all plants open and invest in modernization. But past foreign takeovers in manufacturing have led to plant closures and job cuts. Workers are demanding legally binding guarantees that production levels and union contracts will be preserved.

Are there other companies interested in buying U.S. Steel?

Yes. South Korea’s Posco and Hyundai Steel considered bids but withdrew due to political risks. Domestic firms like Steel Dynamics and Allegheny Technologies have shown interest in buying parts of U.S. Steel, especially its profitable flat-rolled steel operations.

Can the U.S. government stop the sale?

Yes. The Committee on Foreign Investment in the United States (CFIUS) has the legal authority to block the deal if it determines the acquisition threatens national security. CFIUS has blocked similar deals in the past, including Chinese and Russian acquisitions of U.S. industrial assets.