India Chemical Industry Growth Estimator

Estimate India's chemical industry value based on current production and growth rates mentioned in the article.

Projected Industry Value

Based on current industry value of $B and $% annual growth over $ years

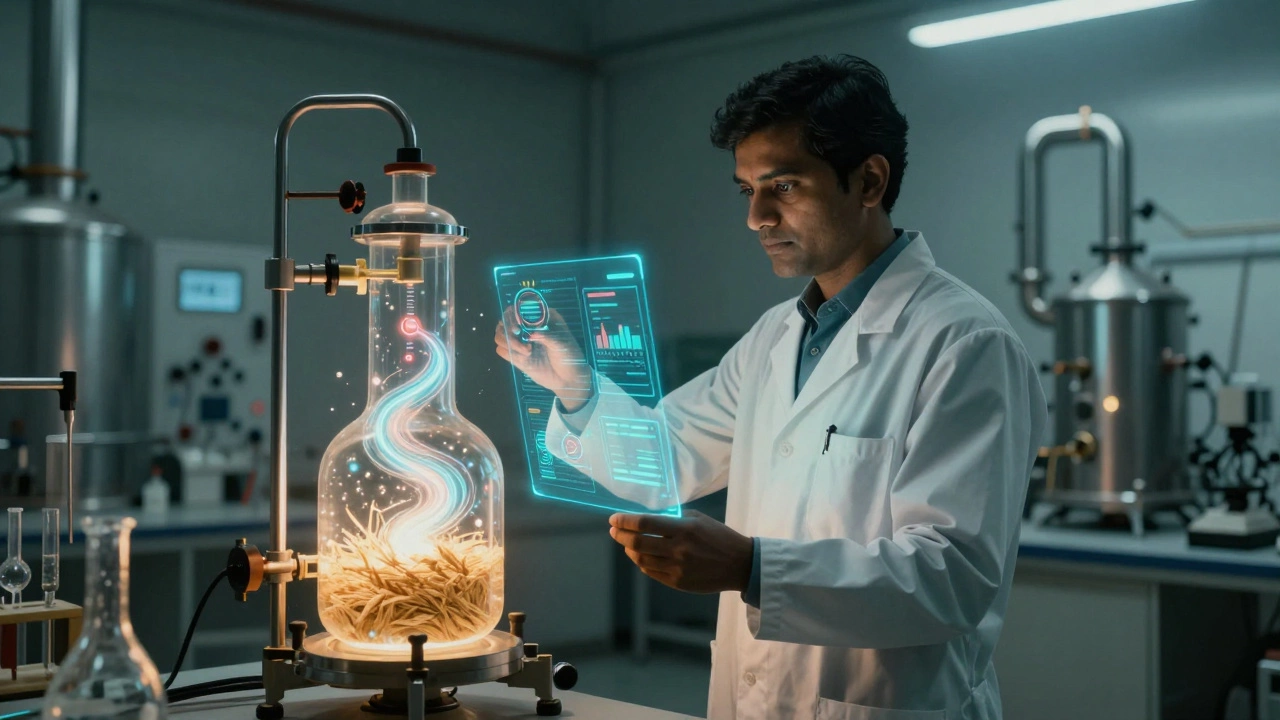

India’s chemical industry isn’t just growing-it’s being rebuilt from the ground up. Over the last five years, domestic production of specialty chemicals has jumped by 32%, and exports hit $68 billion in 2024. This isn’t luck. It’s the result of policy shifts, supply chain realignments, and a new wave of Indian entrepreneurs who are no longer content to be just suppliers to the world-they want to own the technology behind it.

Why India’s chemical industry is no longer just about bulk chemicals

For decades, India was known for making low-margin bulk chemicals: fertilizers, caustic soda, sulfuric acid. These are essential, but they don’t pay well. Today, the focus is shifting to high-value specialty chemicals-pharmaceutical intermediates, electronic chemicals, agrochemicals, and performance polymers. These products are used in everything from smartphones to solar panels to life-saving drugs. And India is now one of the top five global producers of pharma intermediates, supplying over 40% of the active pharmaceutical ingredients (APIs) used in the U.S. and Europe.

The reason? Global supply chains broke during the pandemic. Countries realized they couldn’t rely on China alone for critical chemicals. India stepped in. Companies like Aarti Industries, Deepak Nitrite, and PI Industries didn’t just fill the gap-they built new plants, invested in R&D, and got certified for global standards. Now, they’re not just exporters. They’re partners in innovation.

Government schemes are changing the game

The Production Linked Incentive (PLI) scheme for specialty chemicals, launched in 2021, is the biggest catalyst in decades. The government pledged ₹10,000 crore (about $1.2 billion) to boost domestic manufacturing of 10 key chemical categories. By 2025, over 120 companies have received approvals, with more than ₹5,000 crore already disbursed. The goal? Cut import dependence by 30% in five years.

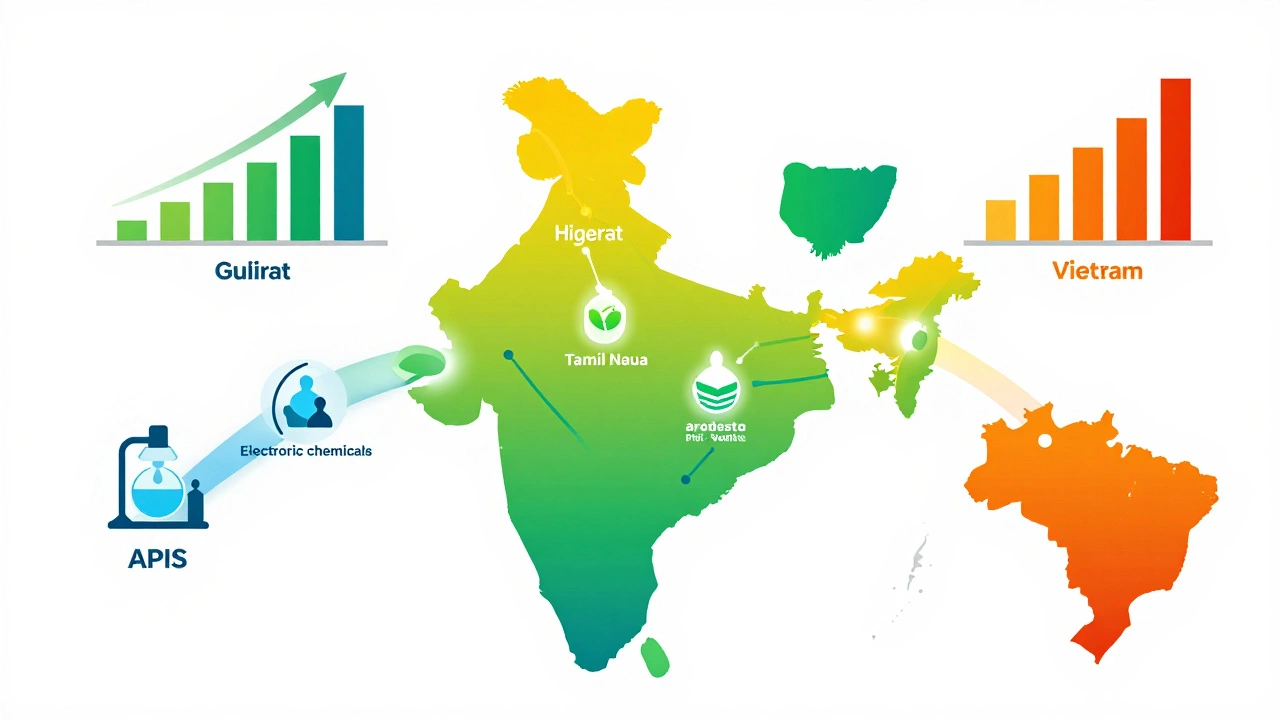

It’s working. In 2023, India imported $18 billion worth of specialty chemicals. In 2024, that dropped to $15.2 billion-even as domestic demand rose. That’s the first time in 20 years imports fell while consumption climbed. The PLI isn’t just about cash. It’s about creating clusters. New chemical parks are being built in Gujarat, Andhra Pradesh, and Tamil Nadu with common infrastructure: waste treatment plants, pipelines, gas supply, and testing labs. This cuts costs for small manufacturers who could never afford these on their own.

Green chemistry is no longer optional

India’s chemical industry is under pressure-from regulators, investors, and customers-to go green. The National Green Hydrogen Mission, launched in 2023, is pushing chemical plants to replace coal with hydrogen for heat and power. By 2030, 10% of all chemical energy in India must come from green hydrogen. That’s not a dream-it’s a requirement for new plant approvals.

Companies are responding. Tata Chemicals built India’s first commercial-scale green ammonia plant in Mithapur, Gujarat. Reliance Industries is investing $10 billion in a zero-carbon chemical complex in Jamnagar. Even small players are switching. A chemical plant in Chennai that used to burn furnace oil now runs on solar-powered steam. Their energy bills dropped by 45%. They also got a 20% tax break under the new Environment Compliance Incentive Scheme.

Water use is another big focus. The chemical industry consumes 12% of India’s industrial water. New regulations now require closed-loop water systems in all new plants. That means zero discharge. It sounds expensive, but companies like Gujarat Alkalies have shown it saves money long-term. They now reuse 95% of their water. Their operating costs fell by 18% in three years.

The talent gap is closing-slowly

One of the biggest bottlenecks in India’s chemical sector has always been skilled labor. Too many engineers graduate without knowing how to operate a reactor or interpret process safety data. That’s changing. IITs and NITs have added new labs focused on process intensification and digital process control. The National Institute of Chemical Technology (NICT) in Pune now runs a 12-week industry-immersion program for final-year students. Over 80% of graduates from that program get hired by chemical firms within a month.

Companies are also training workers directly. Deepak Nitrite runs a factory school in Vadodara where operators learn PLC programming, hazard analysis, and lean manufacturing. They don’t need a degree. They need hands-on skills. The company pays them during training and guarantees a job afterward. Similar programs are now running in Gujarat, Maharashtra, and Telangana.

Export markets are expanding beyond the usual suspects

India’s chemical exports used to go mostly to the U.S., EU, and Gulf countries. Now, they’re heading to Africa, Southeast Asia, and Latin America. In 2024, exports to Nigeria jumped by 67%. To Vietnam, up 52%. To Brazil, up 41%. Why? Because these countries are building their own chemical industries-and they need affordable, reliable partners.

Indian firms are adapting. They’re setting up small warehouses in Lagos and Jakarta. They’re translating product labels into local languages. They’re offering flexible payment terms. One company in Surat started exporting dyes to Ethiopia after a buyer found them on IndiaMART. Within two years, they’re now the top supplier of textile dyes in East Africa.

Challenges still loom large

It’s not all smooth sailing. The biggest hurdle? Access to affordable natural gas. India imports over 80% of its gas. Prices swing wildly. A plant in Gujarat shut down for three weeks in early 2024 because gas supply was cut. That’s not sustainable.

Another problem: land acquisition. Building a chemical plant needs 100-200 acres. Getting that land, especially near ports or rail lines, is slow. Only 12 of the 25 proposed chemical parks have broken ground.

And then there’s the issue of old plants. Many small manufacturers still use 1980s-era technology. Upgrading them costs more than they can afford. The government offers subsidies, but the paperwork is a nightmare. A survey by FICCI found that 62% of small chemical units haven’t applied for PLI because they don’t know how.

What’s next? The next five years

By 2030, India’s chemical industry could be worth $300 billion-up from $175 billion in 2024. That’s a 70% increase. The biggest drivers will be:

- Electronic chemicals: Demand for semiconductor-grade chemicals will grow 15% a year. India is already making photoresists and etchants for local chipmakers.

- Bio-based chemicals: Companies are making plastics from sugarcane and solvents from plant waste. One startup in Bengaluru turned rice husk into a replacement for petroleum-based solvents.

- Energy storage chemicals: Lithium-ion battery materials are a huge opportunity. India imports 90% of its lithium. But now, companies are exploring extraction from geothermal brine and recycling old batteries.

The next big export won’t be just chemicals-it’ll be chemical expertise. Indian firms are already consulting for chemical plants in Egypt, Indonesia, and Mexico. They’re bringing their experience in scaling up safely, affordably, and sustainably.

Final thought: It’s not about being big. It’s about being smart.

India doesn’t need to be the biggest chemical producer in the world. It needs to be the most adaptable. The most efficient. The most innovative. The companies that will win aren’t the ones with the biggest plants. They’re the ones who can pivot fast, cut waste, use AI to optimize reactions, and build trust with global buyers.

The future of India’s chemical industry isn’t written in steel and pipes. It’s written in code, in clean processes, in skilled workers, and in the quiet determination of thousands of engineers and plant operators who show up every day to make something better than yesterday.

Is India becoming a global leader in chemical manufacturing?

Yes, but not in the traditional sense. India isn’t replacing China as the world’s largest producer of bulk chemicals. Instead, it’s becoming a top supplier of high-value specialty chemicals-especially for pharma, electronics, and agrochemicals. With PLI support, green manufacturing, and growing export markets, India is now a key player in global supply chains for critical chemicals.

What are the biggest challenges facing chemical manufacturers in India today?

The top three challenges are: access to affordable natural gas, slow land acquisition for new plants, and outdated technology in small-scale units. Many small manufacturers lack the capital or knowledge to upgrade. While government subsidies exist, complex paperwork deters many from applying. Also, regulatory compliance for environmental standards is tightening, which adds pressure on older plants.

How is the government supporting the chemical industry?

The main support comes through the Production Linked Incentive (PLI) scheme for specialty chemicals, which offers up to 15% financial incentives on incremental sales. The government is also building 25 new chemical parks with shared infrastructure, promoting green hydrogen use, and offering tax breaks for water recycling and emissions reduction. The National Green Hydrogen Mission and Environment Compliance Incentive Scheme are also key drivers.

Are Indian chemical companies exporting more now?

Absolutely. Exports hit $68 billion in 2024, up from $51 billion in 2020. Beyond traditional markets like the U.S. and EU, exports are booming to Africa, Southeast Asia, and Latin America. Indian firms are now supplying APIs, dyes, agrochemicals, and electronic chemicals to countries like Nigeria, Vietnam, Brazil, and Indonesia. Many are setting up local warehouses and adapting packaging to meet regional needs.

What role does sustainability play in India’s chemical industry future?

Sustainability is now a requirement, not an option. New plants must meet zero liquid discharge standards, use renewable energy, and reduce carbon emissions. The push for green hydrogen is forcing companies to rethink energy sources. Water recycling is mandatory. Companies that adopt these practices are seeing lower operating costs and better access to global markets. Sustainability isn’t just ethical-it’s profitable.