Car Shipping Cost Calculator: USA to India 2025

Enter Your Vehicle Details

Estimated Total Cost

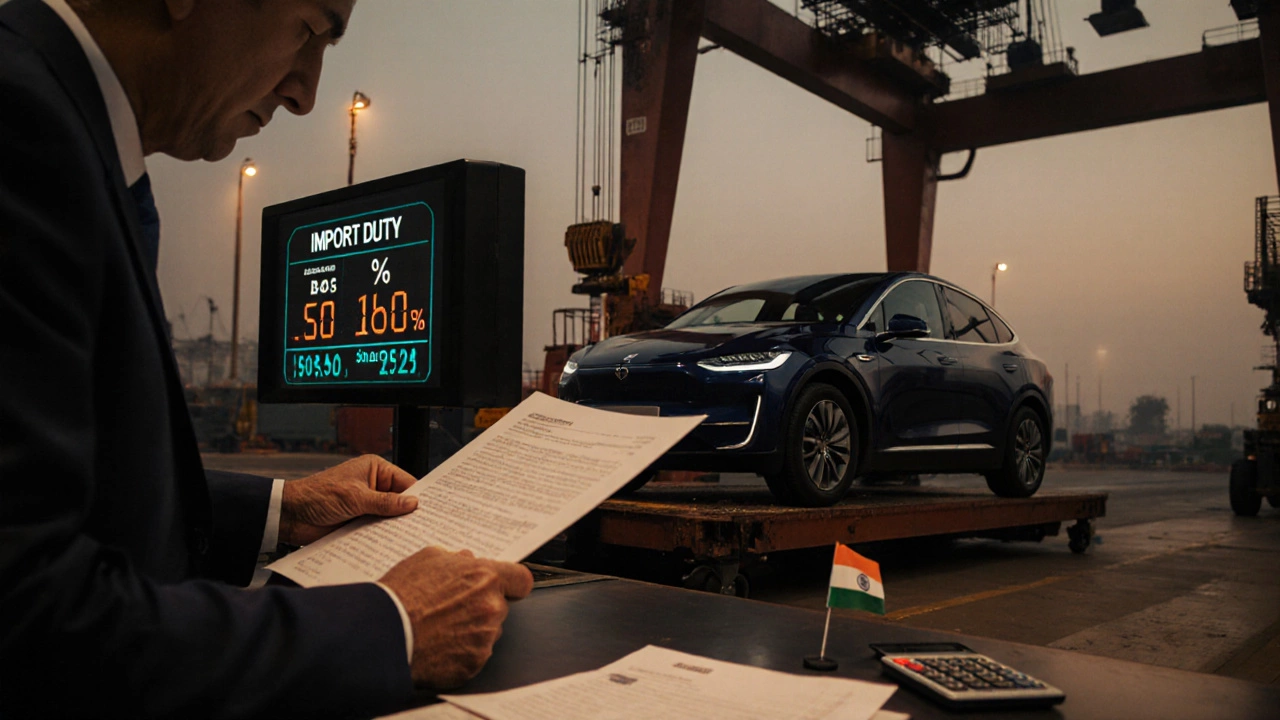

Thinking about bringing a US‑spec car home to India? You’re not alone - the dream of a classic American muscle, a vintage pickup, or a latest‑gen electric model drives many enthusiasts to explore import routes. The big question, though, is the price tag. Below is a step‑by‑step, numbers‑heavy guide that shows exactly what you’ll pay to get a vehicle from an American port to an Indian driveway in 2025.

What Exactly Is Car shipping USA to India?

In simple terms, the process of transporting a motor vehicle from a departure port in the United States to an arrival port in India. It involves a blend of logistics (the physical move), customs paperwork, and compliance with Indian import regulations. The cost combines freight fees, insurance, duties, taxes, and a handful of hidden charges that can surprise first‑time importers.

Why Import a Car from the USA?

- Unique models or trims unavailable locally.

- Potential cost advantage for high‑value classics.

- Access to newer electric or hybrid tech before domestic rollout.

But the allure only pays off when you understand the total landed cost.

Step‑by‑Step Shipping Process

- Choose a reputable freight forwarder.

- Ask for a detailed quote covering all fees.

- Verify they handle customs clearance in India.

- Pick a shipping method - Roll‑on/Roll‑off (RoRo) or a sealed container.

- Prepare the vehicle:

- Drain fuel to < 5%.

- Disconnect battery to avoid leaks.

- Document any pre‑existing damage.

- Load the car at the US port (Los Angeles, New York, or Miami are common).

- Pay port handling and export clearance fees.

- Transit across the Pacific / Atlantic (depending on route).

- Transit time: 20‑45 days.

- Arrive at the Indian port (Mumbai, Chennai, or Kolkata).

- Customs officials assess duty based on HS Code 8703.

- Clear customs, pay duties, taxes, and port charges.

- Vehicle is released to your agent or dealer.

- Transport the car to your home or showroom.

Breaking Down the Costs

Below is a realistic cost matrix for a mid‑range sedan priced at $30,000 (≈ ₹2.5 million at a 1 USD = 83 INR rate). All figures are approximate, based on 2025 market data.

- Purchase price: $30,000 (₹2,490,000)

- Shipping method fee:

- RoRo: $1,200 - $1,500 (₹99,600 - ₹124,500)

- Container: $2,200 - $3,000 (₹182,600 - ₹249,000)

- Insurance (CIF coverage, 1 % of vehicle value): $300 (₹24,900)

- US export documentation and port handling: $200 (₹16,600)

- Indian import duty (≈ 100 % of CIF value for most new cars):

- Duty = 100 % × (Vehicle + Freight + Insurance).

- For a RoRo shipment: $31,500 × 100 % = $31,500 (₹2,614,500)

- Integrated GST (18 % of duty + CIF): ₹472,610

- Port handling & customs clearance in India: $250 - $400 (₹20,800 - ₹33,200)

- Road transport to final destination: $150 - $300 (₹12,500 - ₹24,900)

Adding everything up, a RoRo import of a $30,000 car typically lands between $65,000 - $70,000 (₹5.4 - 5.8 million). A container shipment can push the total toward $75,000 (₹6.2 million) because of the higher freight fee.

Comparison of Shipping Methods

| Method | Cost Range (USD) | Transit Time | Pros | Cons |

|---|---|---|---|---|

| Roll‑on/Roll‑off (RoRo) | $1,200 - $1,500 | 20‑30 days | Cheapest, fast loading, suitable for multiple cars | Cars exposed to weather, limited to operable vehicles |

| Container shipping | $2,200 - $3,000 | 25‑45 days | Protection from elements, can ship non‑operable or high‑value cars safely | Higher cost, longer handling time |

Sample Cost Calculator

Use the following simplified formula to estimate your total landed cost:

Total Cost = Purchase Price + Shipping Fee + Insurance + US Export Fees + (CIF × Import Duty %) + (CIF + Duty) × GST % + Port & Clearance Fees + Inland Transport

Assuming a $25,000 vehicle, RoRo shipping, and 2025 duty rates:

- Purchase Price = $25,000

- Shipping Fee (RoRo) = $1,350

- Insurance (1 %) = $265

- US Export Fees = $200

- CIF = $25,000 + $1,350 + $265 = $26,615

- Import Duty (100 %) = $26,615

- GST (18 %) = 0.18 × ($26,615 + $26,615) = $9,581

- Port & Clearance Fees (India) = $300

- Inland Transport = $200

- Total ≈ $89,541 (≈ ₹7.4 million)

Plug your own numbers into the template and you’ll see a clear picture before you sign any contract.

Tips to Keep Costs Down

- Bundle multiple vehicles in a single RoRo slot - the per‑car fee drops dramatically.

- Negotiate freight forwarder rates; many will match competitor quotes.

- Choose a Indian port with lower handling charges (e.g., Visakhapatnam vs Mumbai).

- Consider a "CFR" (Cost and Freight) quote rather than "CIF" - you can arrange separate insurance if cheaper.

- Check if the car qualifies for the “Used Vehicle” duty exemption - vehicles over 3 years old may attract lower rates.

- Use a trusted customs broker to avoid penalties for mis‑classification under HS Code 8703.

Common Pitfalls and How to Avoid Them

- Under‑estimating duty. Duty is calculated on CIF, not just the purchase price. Always include freight and insurance.

- Solution: Run the cost calculator twice - once with RoRo, once with container - to see the duty impact.

- Ignoring compliance modifications. Indian regulations require left‑hand drive conversion, emission standards, and safety certifications for new cars.

- Solution: Contact the Automotive Research Association of India (ARAI) early to understand mandatory changes.

- Skipping insurance. A claimed loss during transit can wipe out the entire investment.

- Solution: Opt for “All‑Risk” coverage and verify the insurer’s experience with auto freight.

Quick Checklist Before You Ship

- Confirm vehicle eligibility under Indian import norms.

- Get a written quote from at least two freight forwarders.

- Calculate total landed cost using the formula above.

- Arrange pre‑export inspection and obtain a clean title.

- Document VIN, engine number, and odometer reading.

- Secure insurance covering the full CIF value.

- Hire a licensed customs broker familiar with Import duty and GST calculations.

- Schedule inland transport from the Indian port to your destination.

Bottom Line

Bringing a car from the USA to India isn’t just a shipping fee - it’s a layered financial equation. In 2025, a typical mid‑range vehicle will cost somewhere between $65,000 and $80,000 once you factor in duty, GST, and ancillary charges. Knowing each component, using a reliable calculator, and partnering with experienced logistics partners can keep surprises at bay.

What is the import duty rate for cars in India?

For most new passenger vehicles, the duty is 100 % of the CIF (Cost, Insurance, Freight) value. Used cars older than three years may qualify for a reduced rate of 60‑80 %, depending on age and engine size.

Is RoRo cheaper than container shipping?

Generally yes. RoRo fees range from $1,200‑$1,500, while a 20‑foot container costs $2,200‑$3,000. However, RoRo leaves the car exposed to weather and requires a working transmission.

Do I need to pay GST on top of import duty?

Yes. GST is levied at 18 % on the sum of CIF value plus import duty. It’s collected during customs clearance.

Can I import a left‑hand‑drive car and keep it as‑is?

No. Indian law requires all passenger vehicles to be left‑hand‑drive. Converting a right‑hand‑drive car involves substantial alteration costs and must be certified by ARAI.

How long does customs clearance take?

If documentation is complete, clearance typically takes 2‑5 business days. Incomplete paperwork can stretch the process to weeks.