Textile Manufacturing Cost Comparison Tool

Compare production costs across top textile manufacturing destinations using real data from the article. Input your production volume, fabric type, and choose countries to see how costs, lead times, and sustainability metrics compare.

Cost Comparison

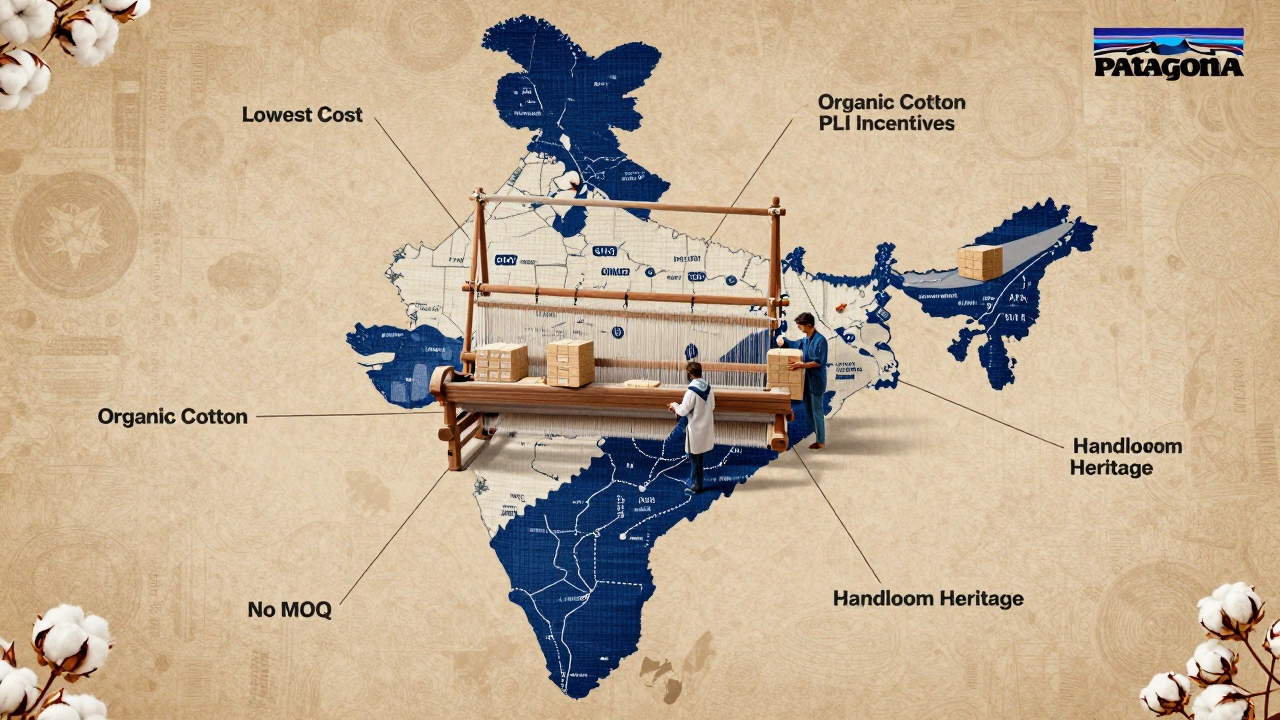

Key Advantage: India offers full vertical integration with no minimum order quantity (MOQ) trap and government incentives like RoDTEP and PLI that reduce export costs by up to 12%.

When you’re starting or expanding a textile business, the country you choose can make or break your margins, speed, and scalability. It’s not just about cheap labor anymore. In 2025, the best country for textile business balances cost, infrastructure, sustainability, trade deals, and skilled labor - and one name keeps coming up at the top: India.

Why India Leads the Global Textile Game

India has been making textiles for over 5,000 years. Today, it’s the world’s second-largest producer of cotton and the largest producer of handloom fabrics. The country churns out more than 5 billion meters of fabric annually, with over 1.5 million textile units spread across states like Tamil Nadu, Gujarat, Maharashtra, and Uttar Pradesh.

What makes India stand out? First, the labor force. Over 45 million people work directly in textiles - from spinners and weavers to dyers and exporters. Many of these workers are trained in traditional techniques like block printing, ikat, and hand embroidery, which global brands pay a premium for. Second, the supply chain is fully integrated. You can source raw cotton in Gujarat, spin yarn in Tamil Nadu, weave fabric in Maharashtra, dye it in Ludhiana, and ship finished garments from Chennai or Surat - all within a 1,000-kilometer radius.

India also has the lowest cost per unit for basic woven and knitted fabrics compared to China, Bangladesh, or Vietnam. According to the Textile Ministry’s 2024 report, the average labor cost for making a cotton t-shirt in India is $0.28. In Bangladesh, it’s $0.35. In China, it’s $0.52. And that’s without factoring in India’s 15% export incentive under the RoDTEP scheme.

China’s Decline and the Shift Away

For years, China was the default choice for textile buyers. But things have changed. Labor costs have doubled since 2015. Minimum wage in Guangdong rose from $1.80/hour in 2018 to $3.10/hour in 2025. Environmental regulations have tightened, forcing small factories to shut down or upgrade at huge cost.

Plus, geopolitical tensions and tariffs are making China risky. The U.S. and EU have imposed forced labor bans on Xinjiang cotton, which used to make up 20% of China’s output. Brands are now avoiding any supply chain tied to the region. Many Chinese exporters are shifting production to Southeast Asia - but that just opens the door for India.

Bangladesh and Vietnam: The Fast Followers

Bangladesh is still strong in ready-made garments. It’s the second-largest exporter of apparel after China, with over 4,000 factories. Labor costs are low - around $0.35/hour - and the country has deep experience with big brands like H&M and Walmart. But there’s a catch: Bangladesh lacks vertical integration. Most factories import yarn and fabric from India, China, or Turkey. That adds lead time and cost.

Vietnam is growing fast, especially in technical textiles and high-value apparel. Its labor force is more educated, and it has free trade agreements with the EU and UK. But Vietnam’s textile industry is still young. It doesn’t have enough raw cotton or spinning capacity. Over 70% of its fabric is imported, mostly from India. That makes it a middleman, not a full-stack player.

India’s Hidden Advantages

India doesn’t just make clothes - it makes options. Want organic cotton? India grows 60% of the world’s organic cotton. Want recycled polyester? Gujarat has over 200 recycling units that turn plastic bottles into fiber. Want sustainable dyes? Tamil Nadu’s small units use natural dyes from indigo, turmeric, and pomegranate rind.

India also has the most flexible production scale. You can order 100 units or 100,000. There’s no minimum order quantity (MOQ) trap like in China. Small designers and startups can work with local clusters in Tiruppur or Erode without signing long-term contracts.

Logistics? India has 12 major ports, with Chennai and Mundra handling over 40% of textile exports. Customs clearance for textiles takes under 48 hours in most ports. And with the government’s Production Linked Incentive (PLI) scheme offering up to 12% cashback on exports, margins are getting tighter for competitors.

What About Turkey, Pakistan, or Indonesia?

Turkey is great for European buyers. It’s close, has high-quality finishing, and meets EU standards easily. But labor costs are higher than India’s, and it doesn’t produce its own cotton. Pakistan has strong spinning capacity and low costs, but political instability and power shortages make it risky. Indonesia has cheap labor and natural fibers like jute and bamboo, but lacks export infrastructure and textile innovation.

None of these countries match India’s combination of scale, variety, speed, and cost.

Real-World Example: A U.S. Brand’s Switch to India

In 2023, a New York-based sustainable fashion brand called EarthWear moved its entire production from Vietnam to Tamil Nadu. Why? Their lead time dropped from 45 days to 18. Their cost per unit fell by 22%. And they gained access to handwoven Kanchipuram silk and organic cotton from Andhra Pradesh - products they couldn’t get anywhere else.

They now work with a cluster of 12 small factories in Erode, each specializing in a different stage: spinning, dyeing, printing, stitching. They pay upfront for fabric, not finished goods, which gives them control over quality. And they’ve seen customer retention jump by 34% because they can now tell a real story about where their clothes come from.

The Risks of Choosing India

It’s not perfect. Power cuts still happen in rural clusters. Some small mills use outdated looms. Communication gaps can occur if you’re working with a factory that doesn’t have an English-speaking manager. And quality control? It varies.

The fix? Don’t pick one factory. Work with a sourcing agent or a textile hub like the Apparel Export Promotion Council (AEPC) in Delhi or the Coimbatore Textile Cluster. They vet suppliers, handle inspections, and even arrange third-party audits. Most reputable agents charge 3-5% of order value - far less than the cost of a bad shipment.

Final Verdict: India Is Still the Best

By 2025, India is the only country that offers:

- Full vertical integration - from cotton to finished garment

- Lowest cost per unit with high quality

- Massive skilled labor force trained in both traditional and modern techniques

- Government incentives that reduce export costs

- Access to sustainable, organic, and handcrafted materials

- Flexible order sizes and fast turnaround

Bangladesh and Vietnam are good for simple, high-volume orders. China is fading. Turkey is expensive. Pakistan is unstable.

If you’re serious about building a textile business that’s profitable, scalable, and ethical - India isn’t just the best option. It’s the only one that gives you real control, creativity, and cost savings all at once.

Is India still the best country for textile manufacturing in 2025?

Yes. India leads in cost, scale, sustainability, and flexibility. It’s the only country with full vertical integration - from cotton farming to garment exports - and government incentives like RoDTEP and PLI that cut export costs by up to 12%. Labor costs are lower than China and Vietnam, and quality in handloom and organic textiles is unmatched.

Why are brands moving away from China for textiles?

Brands are leaving China because of rising labor costs, strict environmental rules, and trade bans on Xinjiang cotton. Many U.S. and EU companies now avoid any supply chain tied to Xinjiang due to forced labor concerns. China’s export growth in textiles has slowed to under 2% annually since 2022, while India’s grew by 14% in 2024.

Can small businesses work with Indian textile manufacturers?

Absolutely. Unlike China, where MOQs often start at 5,000 units, Indian clusters in Tiruppur, Erode, and Surat accept orders as small as 100 pieces. Many factories specialize in serving startups and niche brands. Working with a local sourcing agent ensures you get quality control and fair pricing without needing a large team.

What are the top textile-producing states in India?

Tamil Nadu (especially Coimbatore and Erode) leads in cotton spinning and knitwear. Gujarat dominates synthetic fiber and dyeing. Maharashtra handles large-scale weaving and denim. Uttar Pradesh and Rajasthan are hubs for handloom and zari work. Each state has specialized clusters with trained workers and export-ready infrastructure.

How do I find reliable textile suppliers in India?

Start with the Apparel Export Promotion Council (AEPC) or the Cotton Textile Export Promotion Council (TEXPROCIL). They maintain verified lists of exporters. Attend trade fairs like the India International Textile Fair in Delhi. Or hire a local sourcing agent - they’ll handle visits, inspections, and logistics for 3-5% of your order value. Avoid buying from random Alibaba sellers; many are traders, not manufacturers.

Are Indian textiles sustainable and eco-friendly?

Yes. India produces 60% of the world’s organic cotton and has over 200 recycling units that turn plastic bottles into polyester fiber. Many small mills use natural dyes from turmeric, indigo, and neem. The government also certifies eco-friendly units under the Green Textile Scheme. Brands like Patagonia and People Tree source directly from these sustainable clusters.