Manufacturing Profit Margin Calculator

Calculate Your Profit Margin

Industry Comparison

Compare your margin to high-performance manufacturing sectors from the article

| Industry | Average Gross Margin | Key Factors |

|---|---|---|

| Pharmaceutical | 72% | Patent protection, pricing power |

| Specialty Chemicals | 50-70% | High-value formulations, specialized customers |

| Medical Devices | 60-70% | Regulatory moats, patient-specific products |

| Electronics | 8-12% | Commoditized products, low pricing power |

| Food Processing | 8-12% | Low pricing power, high distribution costs |

What Your Margin Means

Note: Gross margin doesn't account for operating expenses, taxes, or capital investment requirements. High-margin industries often have higher entry barriers and longer time to profitability.

When people think about manufacturing, they often picture factories with loud machines and workers in hard hats. But behind the noise, some manufacturing businesses are making far more money than others-not because they work harder, but because they sell products with much higher profit margins. If you’re looking to start or invest in manufacturing, the real question isn’t just which manufacturing has highest profit, but which ones turn raw materials into cash with the least friction and the most demand.

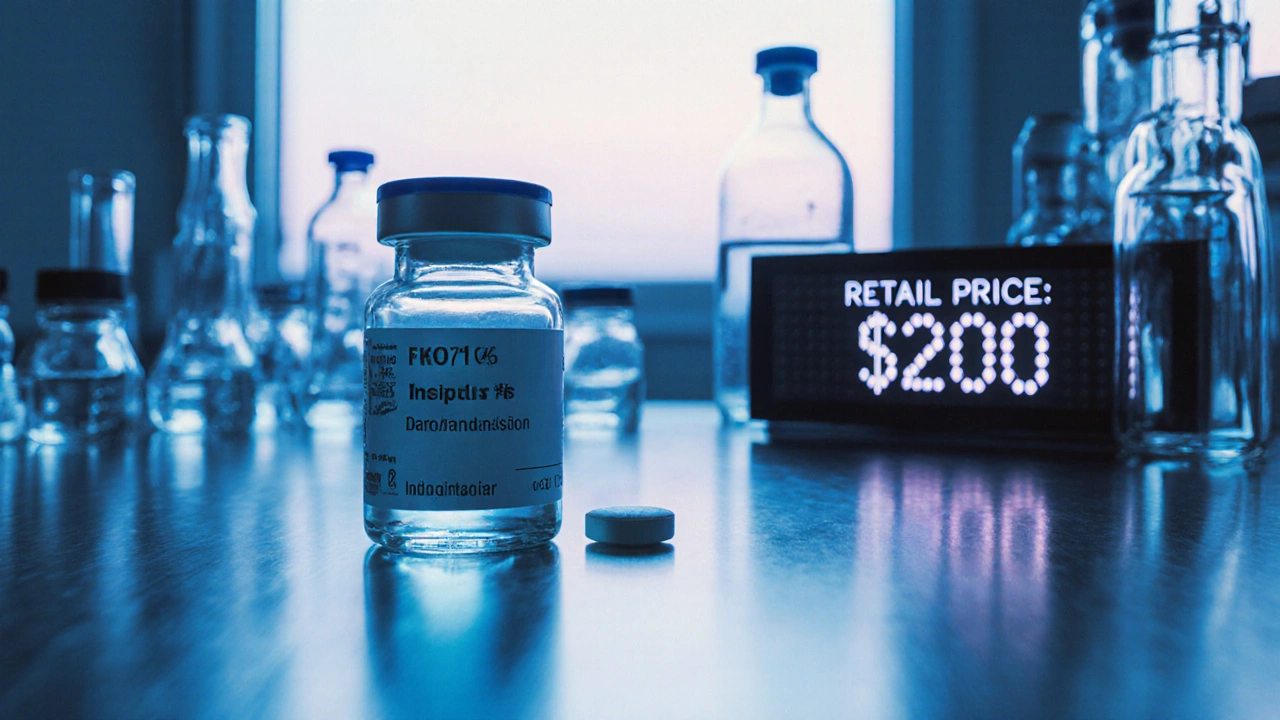

Pharmaceutical Manufacturing Leads by a Wide Margin

Pharmaceutical manufacturing isn’t just about pills and syringes-it’s about intellectual property, regulatory moats, and pricing power that few other industries can match. A single bottle of a patented drug can cost $2 to produce but sell for $200 or more. Even generic drugs, after the patent expires, still carry 30-50% gross margins because production is highly optimized and scaled.

In 2024, the global pharmaceutical manufacturing sector reported average gross profit margins of 72%, according to data from the U.S. Bureau of Economic Analysis and industry reports from IQVIA. Compare that to electronics manufacturing, where margins hover around 8-12%, or furniture manufacturing, which struggles to break 15%. The reason? You’re not just selling a product-you’re selling a solution to pain, illness, or even death. People pay for that.

Big pharma companies like Pfizer, Moderna, and Novartis don’t just make drugs-they control the entire pipeline: R&D, clinical trials, FDA approvals, distribution, and pricing. Even smaller manufacturers that specialize in niche generics or compounded medications can achieve 40-60% margins if they focus on high-demand areas like diabetes, cardiovascular, or mental health drugs.

Specialty Chemicals: The Hidden Profit Engine

While bulk chemicals like chlorine or sulfuric acid barely break even, specialty chemicals are a different story. These are high-value compounds used in electronics, cosmetics, agriculture, and advanced materials. Think of the chemical that makes your smartphone screen scratch-resistant, or the additive that keeps your shampoo from separating.

Companies that produce specialty chemicals often operate in small batches with custom formulations. Their customers-tech firms, beauty brands, or aerospace manufacturers-are willing to pay premium prices because these chemicals are critical to their own products. Gross margins here regularly hit 50-70%.

For example, a small manufacturer producing photolithography chemicals for semiconductor fabrication can charge $500 per liter. The raw materials cost maybe $30. That’s a 94% gross margin. And because these chemicals are part of complex supply chains, switching suppliers is risky and expensive. Once you’re in, you’re locked in.

Medical Device Manufacturing: High Entry, Higher Returns

Medical devices-think pacemakers, insulin pumps, diagnostic tools, and surgical instruments-require FDA approval, ISO certifications, and years of testing. That sounds like a barrier, and it is. But once you clear it, the rewards are massive.

Unlike pharmaceuticals, where patents expire, many medical devices are protected by design patents and proprietary manufacturing techniques. A simple glucose monitor can cost $15 to make and sell for $400. Orthopedic implants? Margins often exceed 70%.

Even small players are thriving. A company in Ohio that makes custom 3D-printed spinal implants saw 68% gross margins last year. Why? Each implant is tailored to the patient’s anatomy. No two are alike. Competitors can’t just copy it-they need patient scans, specialized software, and certified production lines.

Electronics Manufacturing: Volume Over Value

It’s easy to assume electronics must be profitable because we’re surrounded by gadgets. But the reality is brutal. Most consumer electronics manufacturers operate on razor-thin margins. A smartphone maker might earn $50 profit on a $1,000 phone, but that’s after spending $800 on parts, labor, marketing, and logistics.

Companies like Apple and Samsung make money because they control the brand, software, and ecosystem. But contract manufacturers like Foxconn or Pegatron? They make pennies per unit. Gross margins for contract electronics manufacturing are often below 10%. Even companies making smart home devices or wearables struggle to hit 15% unless they own the IP.

If you’re thinking of entering electronics manufacturing, don’t just build gadgets. Build the chips, sensors, or firmware inside them. That’s where the real money is.

Food Processing: Low Risk, Low Reward

Everyone eats, so food manufacturing seems like a safe bet. And it is-low failure rates, steady demand, easy distribution. But profits? They’re modest. A bag of potato chips might cost 35 cents to make and sell for $3. That’s an 89% markup, but after packaging, shipping, retail shelf space, and advertising, net margins drop to 8-12%.

High-margin food niches exist, though. Think artisanal supplements, functional foods with added probiotics or adaptogens, or premium organic baby food. These products command 40-60% gross margins because they’re sold as health solutions, not just snacks. But they require strong branding, certification (USDA Organic, Non-GMO, etc.), and direct-to-consumer channels to avoid getting crushed by Walmart and Kroger’s private labels.

Why Some Manufacturing Profits Are Illusory

Not all high-margin businesses are easy to run. Pharmaceutical and medical device manufacturing require millions in upfront investment, years of regulatory approval, and constant compliance. One FDA violation can shut you down. Specialty chemicals need skilled chemists and strict safety protocols. These aren’t side hustles.

Meanwhile, low-margin businesses like furniture or textiles might seem less profitable, but they’re easier to start. You can launch a small furniture business with $20,000 and local suppliers. You don’t need a PhD or a legal team. Profit per dollar invested might be lower, but the barrier to entry is too.

Profit isn’t just about the percentage on a spreadsheet. It’s about capital efficiency, scalability, and risk. A 70% margin on $1 million in sales is $700,000 profit. A 15% margin on $10 million is $1.5 million. Sometimes, volume beats margin.

What You Should Do Next

If you’re serious about manufacturing for maximum profit:

- Look for industries where you control the IP or proprietary process-not just assembly.

- Avoid commoditized products where price is the only differentiator.

- Target regulated markets (pharma, medical devices, specialty chemicals) where competitors are limited by law, not just cost.

- Start small: Don’t try to build a drug factory. Start by making a single high-margin component, like a diagnostic test strip or a specialty polymer additive.

- Build relationships with end-users, not just distributors. The closer you are to the customer, the more pricing power you have.

Manufacturing isn’t dying-it’s evolving. The old model of mass-producing cheap goods is fading. The future belongs to manufacturers who solve specific problems with high-value, hard-to-copy products. The highest profits aren’t in making more. They’re in making things that others can’t easily replace.

Is pharmaceutical manufacturing the most profitable type of manufacturing?

Yes, pharmaceutical manufacturing typically has the highest gross profit margins-often 70% or more-due to patent protection, high pricing power, and low production costs relative to sale price. Even generic drug makers achieve 30-50% margins. This outpaces electronics, food, or furniture manufacturing, where margins are usually under 20%.

Can you make good money in electronics manufacturing?

It’s hard. Most electronics manufacturers that just assemble products (like phone or laptop makers) operate on 5-12% gross margins. Profit comes from brand control, software, and ecosystem lock-in-not the hardware itself. If you want high profits in electronics, focus on designing chips, sensors, or proprietary firmware that others need to license.

What’s the easiest manufacturing business to start with high profit?

There’s no truly easy path to high profit in manufacturing. But specialty chemicals for cosmetics or niche food additives (like plant-based preservatives or flavor enhancers) offer a good balance. You can start small with lab-scale production, target direct B2B clients, and avoid heavy regulation. Margins of 40-60% are possible without needing FDA approval for every batch.

Why do some manufacturing businesses fail even with high margins?

High margins don’t guarantee success. Pharmaceutical and medical device companies often fail because they run out of cash before getting regulatory approval. It can take 5-10 years and $100 million+ to bring a new drug to market. Without funding, patience, or legal expertise, even the most profitable idea can collapse before it earns a dime.

Are there any emerging manufacturing sectors with rising profits?

Yes. Battery component manufacturing for EVs, especially lithium-ion cathode materials, is seeing margins jump to 50-60% as demand surges. Another is biodegradable packaging materials-companies replacing plastic with plant-based films are charging 3-5x more than traditional plastic suppliers. These are new, fast-growing niches with low competition and high customer willingness to pay.