MSME Classification Calculator

Enter your business details below to determine whether your enterprise qualifies as a micro or small unit according to the 2025 MSME classification.

Classification Result

When you hear people talk about the backbone of India’s economy, the term micro small scale industry often pops up. But what does it really mean, and why does it matter to a small town entrepreneur, a city‑based investor, or a policy‑maker in Delhi? This guide breaks down the definition, classification, and practical steps to get your venture off the ground, while spotlighting the schemes that keep the sector humming.

What Exactly Is a Micro Small Scale Industry?

Micro Small Scale Industry (MSME) is a category of enterprises defined by the Indian government based on investment in plant and machinery (for manufacturing) or equipment (for services). It encompasses both “micro” and “small” units, each with distinct thresholds.

Classification: Micro vs. Small

The Ministry of Micro, Small and Medium Enterprises (MSME) uses two key parameters - investment and annual turnover. As of the 2025 revision, the limits are:

| Category | Investment (₹) | Turnover (₹) |

|---|---|---|

| Micro | Up to 1 crore | Up to 5 crore |

| Small | More than 1 crore up to 10 crore | More than 5 crore up to 50 crore |

These figures apply to both manufacturing and service‑sector units, making the classification simple yet powerful for policy targeting.

Why MSMEs Matter: Numbers That Speak

According to the Ministry’s 2024 report, MSMEs contribute about 30% of India’s GDP and employ over 110 million workers. Over 60% of all industrial output comes from MSMEs, and they account for roughly 45% of total exports. In Bangalore alone, the MSME ecosystem powers more than 8,000 tech‑enabled manufacturing units, ranging from 3‑D printing labs to precision component makers.

Key Government Schemes Supporting MSMEs

Getting a micro or small enterprise started is easier when you tap into the right schemes. Below are the most impactful programmes as of 2025:

- Credit Guarantee Fund Trust for Micro and Small Enterprises (CGTMSE) - Provides collateral‑free loans up to ₹2 crore for eligible MSMEs.

- Prime Minister’s Employment Generation Programme (PMEGP) - Offers subsidy of up to 35% for setting up new micro‑units.

- SIDBI’s MSME Development Fund - Low‑interest term loans for technology upgradation and working capital.

- Make in India Initiative - Encourages manufacturing MSMEs with tax benefits and easier export procedures.

- National Investment and Manufacturing Zones (NIMZ) - Offers land and infrastructure at concessional rates for clustered MSMEs.

Each scheme comes with its own eligibility checklist; most require a valid Udyog Aadhaar (now Udyam Registration) number.

Step‑By‑Step Guide to Registering an MSME

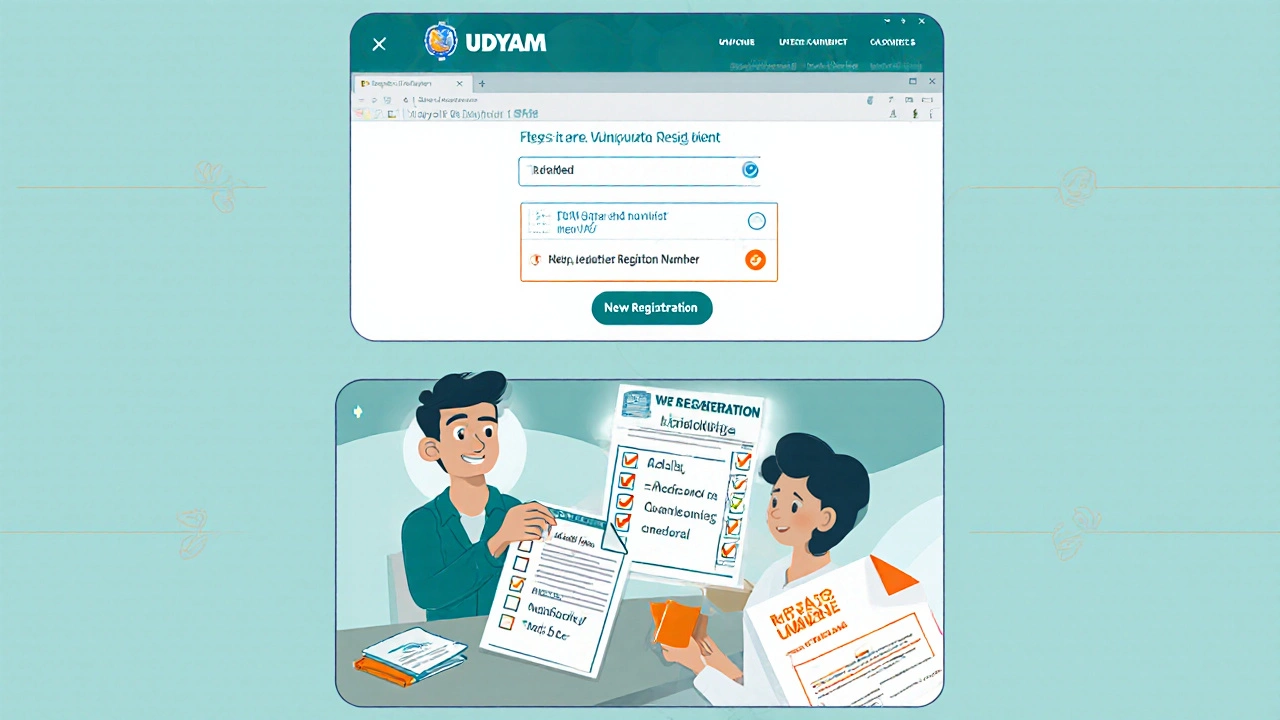

- Visit the Udyam Registration portal and click “New Registration”.

- Enter your PAN, Aadhaar, and business address. The system will auto‑populate your name and GST details if linked.

- Select the category - micro or small - based on your projected investment and turnover.

- Provide details of your main activity (e.g., “handloom weaving” or “metal stamping”).

- For manufacturing, specify plant & machinery value.

- For services, list equipment cost.

- Upload supporting documents: PAN card, Aadhaar, proof of address, and a bank statement showing capital.

- Submit the form. You’ll receive a unique Udyam Registration Number (URN) instantly via email and SMS.

- Register for GST, if your turnover exceeds the exemption limit (₹40 lakh for services, ₹20 lakh for goods).

- Apply for relevant schemes (CGTMSE, PMEGP, etc.) using the URN as reference.

Once registered, you can claim benefits such as priority sector lending, subsidised patents, and participation in export promotion councils.

Common Challenges and Pro Tips

Even with government support, many MSMEs stumble on a few recurring hurdles. Here’s how to dodge them:

- Cash Flow Gaps: Keep a rolling 3‑month cash‑flow forecast. Use CGTMSE for short‑term working capital instead of costly overdrafts.

- Technology Lag: Leverage the Digital MSME Portal for free training modules on Industry 4.0 tools.

- Regulatory Overload: Appoint a compliance officer or outsource to a chartered accountant familiar with MSME filings.

- Market Access: Join local trade associations; they often organize buyer‑seller meets under the Make in India banner.

- Talent Retention: Offer skill‑upgradation scholarships through the Skill India programme - it boosts employee loyalty and reduces turnover.

Future Outlook: Where Is the MSME Sector Headed?

By 2030, the government aims to double the MSME contribution to GDP. The push for green manufacturing, digital payments, and AI‑driven quality control is reshaping the landscape. Entrepreneurs who adopt sustainable practices now-like solar‑powered workshops or waste‑to‑energy units-stand to receive extra subsidies under the “Green MSME” pilot launched in 2024.

Frequently Asked Questions

What is the difference between a micro and a small enterprise?

A micro enterprise invests up to ₹1crore and earns a turnover of up to ₹5crore. A small enterprise invests between ₹1crore and ₹10crore with turnover between ₹5crore and ₹50crore. The thresholds apply equally to manufacturing and services.

Do I need a separate GST registration for my MSME?

Only if your projected annual turnover exceeds the GST exemption limit (₹40lakh for services, ₹20lakh for goods). Otherwise, GST registration is optional but can help you claim input tax credit.

Can startups qualify for MSME schemes?

Yes. As long as the startup meets the investment and turnover criteria, it can register as an MSME and access CGTMSE loans, SIDBI funding, and PMEGP subsidies.

How long does the Udyam registration process take?

The online portal generates the Udyam Registration Number instantly after you submit the form and documents. The whole process can be completed in under 30minutes.

What are the main benefits of being an MSME?

Key benefits include priority sector lending, lower interest rates, tax rebates, easier export procedures, and eligibility for a host of central and state‑level subsidies aimed at technology adoption, skill development, and market expansion.