Heavy Machinery Total Cost Calculator

When you think of heavy machinery, two names come up more than any others: Caterpillar and Komatsu. If you’re in construction, mining, or infrastructure in India, you’ve probably seen their machines on site. But which one is really bigger? It’s not just about how many bulldozers they sell-it’s about global reach, financial power, and who controls the future of earthmoving equipment.

Revenue and Market Size

In 2025, Caterpillar reported $58.2 billion in annual revenue. Komatsu came in at $34.1 billion. That’s a difference of over $24 billion. Caterpillar isn’t just bigger-it’s nearly 70% larger in sales. This isn’t a fluke. For over a decade, Caterpillar has held the top spot in global construction and mining equipment revenue. Komatsu is the clear #2, but the gap hasn’t closed.

Why does revenue matter? Because it shows how much customers trust each brand. In India, where infrastructure projects are booming, contractors don’t just buy machines-they invest in reliability. Caterpillar’s higher revenue means more service centers, more spare parts in stock, and more trained technicians across the country. In cities like Pune, Ahmedabad, and Hyderabad, Caterpillar service hubs are more common than Komatsu’s.

Global Footprint and Manufacturing Reach

Caterpillar operates in over 190 countries. It has major manufacturing plants in the U.S., Japan, Brazil, China, and India. Its Pune plant, opened in 2009, makes engines and hydraulic components for global markets. It’s one of the largest Cat manufacturing sites outside the U.S.

Komatsu also has a strong global presence, with factories in Japan, the U.S., Germany, and China. But in India, Komatsu’s footprint is smaller. It opened its first Indian plant in 2017 in Chennai, focused mainly on backhoe loaders and compact equipment. While it’s growing, it still doesn’t match Caterpillar’s scale in local production or distribution.

For Indian buyers, this means Caterpillar has more parts available locally. Need a replacement track shoe for a 797 haul truck? Caterpillar’s Pune warehouse likely has it. Komatsu might need to ship it from Japan or Thailand-adding weeks to downtime.

Product Range and Specialization

Caterpillar offers over 300 product lines. From tiny 1-ton mini excavators to 400-ton mining trucks, they cover every segment. Their 797 mining truck can carry 400 tons in a single load. That’s more than 20 full-sized trucks combined.

Komatsu’s range is narrower. They make excellent excavators, dozers, and haul trucks-but they don’t compete in some high-end mining equipment. For example, Komatsu doesn’t make a direct rival to Caterpillar’s 797. Their biggest haul truck, the PC1000, carries 220 tons-less than half of Cat’s top model.

In India, where large mining and road projects dominate, Caterpillar’s full lineup gives contractors one-stop access. Need a dozer, an excavator, and a haul truck that all work together? Caterpillar’s machines are designed as a system. Komatsu’s machines work well too, but you’re more likely to mix brands on site.

Service and Support Network

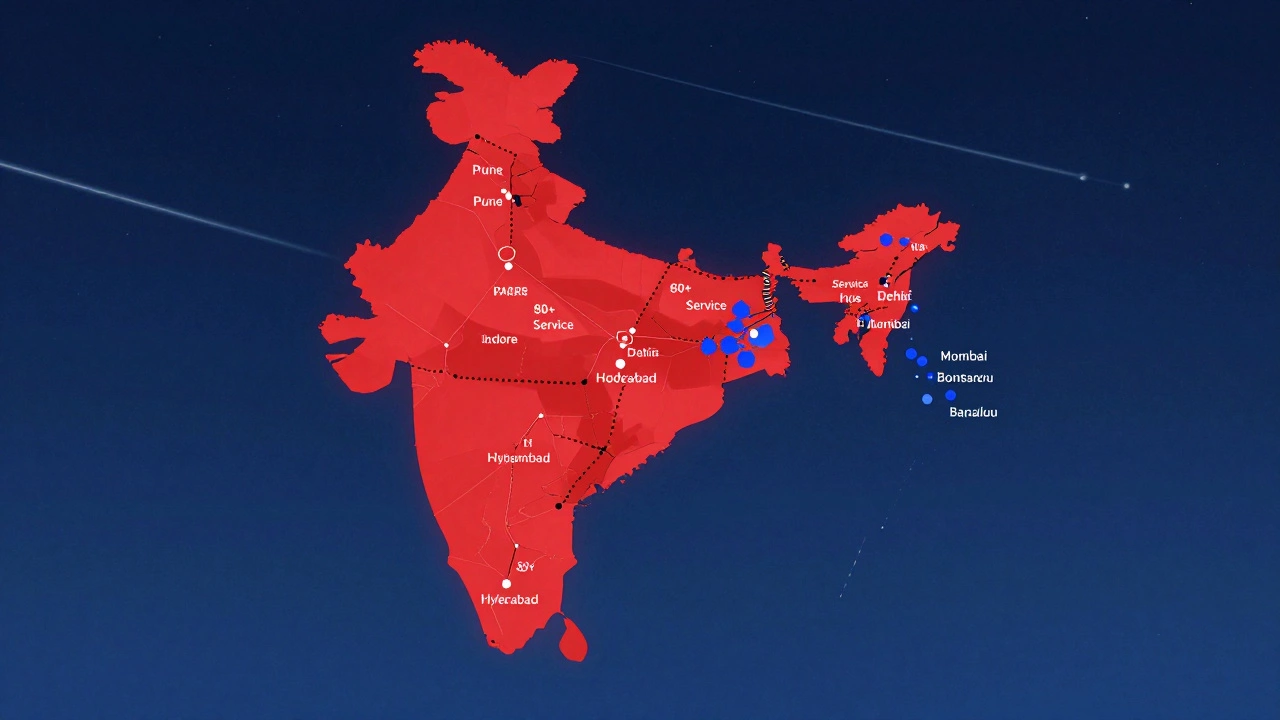

Heavy machinery breaks down. When it does, you need help fast. Caterpillar’s global service network has over 1,500 dealer locations worldwide. In India, they partner with major distributors like Ashok Leyland and Tata Hitachi to ensure coverage in Tier 2 and Tier 3 cities.

Komatsu relies on fewer partners in India. Their network is strongest in metro areas like Delhi, Mumbai, and Bengaluru. But in places like Raipur, Jhansi, or Bhavnagar, finding a Komatsu-certified technician can be hard. Caterpillar’s service teams are more likely to show up the same day.

There’s also software. Caterpillar’s Cat Connect system tracks machine health, fuel use, and maintenance schedules in real time. Over 70% of new Cat machines sold in India come with this system. Komatsu has a similar platform called Komtrax, but it’s less widely adopted in the Indian market.

Market Share in India

In India’s construction equipment market, Caterpillar holds about 28% of the volume share. Komatsu sits at 12%. That’s a clear lead. In mining equipment, Caterpillar’s share jumps to over 35%, especially in iron ore and coal operations in Odisha and Chhattisgarh.

Why the gap? Price isn’t the main reason. Komatsu machines are often cheaper. But Indian buyers care about total cost of ownership. A Cat machine might cost 15% more upfront, but it lasts longer, uses less fuel, and costs less to repair. Over five years, that adds up.

Also, banks and financiers in India prefer to fund Caterpillar purchases. Why? Because resale value is higher. A used Cat 320 excavator holds 60% of its original value after five years. A Komatsu 320 holds closer to 50%.

Who’s Winning the Future?

Both companies are investing in electric machines. Caterpillar’s 305.5E electric excavator is already being tested on Indian sites. Komatsu has its own electric models, but they’re still in pilot phases. Caterpillar’s scale lets them roll out new tech faster.

Also, Caterpillar’s R&D budget is over $2 billion a year. Komatsu spends about $1.1 billion. That means more innovation, more patents, and more upgrades hitting the market first.

In India, where government projects like the National Highways Authority and Smart Cities demand high-performance equipment, Caterpillar’s lead in technology and support gives them the edge.

Final Verdict: Size Isn’t Just About Machines

Komatsu makes great equipment. Their machines are reliable, efficient, and well-built. But when you ask who’s bigger, you’re not just asking about size of machines-you’re asking about scale of operations, depth of support, financial strength, and long-term reliability.

Caterpillar is bigger in revenue, market share, service coverage, product range, and innovation. In India, where downtime costs thousands per hour, that matters more than price tags.

That doesn’t mean Komatsu isn’t worth considering. For small contractors or niche applications, Komatsu offers smart, cost-effective options. But if you’re running a large project, managing a fleet, or planning for the next five years, Caterpillar’s size gives you more confidence.

Is Caterpillar more expensive than Komatsu in India?

Yes, Caterpillar machines typically cost 10-20% more upfront than Komatsu equivalents. But when you factor in fuel efficiency, resale value, and lower repair costs over five years, Caterpillar often ends up cheaper overall. Many Indian contractors say the higher initial price is worth it for fewer breakdowns and faster service.

Which brand has better parts availability in Tier 2 cities in India?

Caterpillar has a clear advantage. With over 80 authorized service centers across India-including in cities like Indore, Bhopal, and Coimbatore-parts are usually in stock. Komatsu’s network is concentrated in metros. In smaller towns, you might wait 2-3 weeks for a part to arrive from Chennai or Mumbai.

Do Indian mining companies prefer Caterpillar or Komatsu?

Most large mining companies in India, including Vedanta, Adani, and JSW, use Caterpillar haul trucks and excavators. The 797 and 994 models are standard on major sites. Komatsu is used in smaller operations or where budget is tight, but Caterpillar dominates high-volume mining.

Are Komatsu machines more fuel-efficient than Caterpillar?

In recent models, the difference is small. Both brands use advanced engines that meet Bharat Stage VI emissions standards. Komatsu’s machines sometimes use slightly less fuel in light-duty tasks. But Caterpillar’s systems, like the Cat Connect telematics, help operators reduce fuel waste by up to 12% through better driving habits. Overall, the real savings come from how you use the machine, not just the brand.

Which brand is better for rental companies in India?

Caterpillar is the top choice for rental fleets. Their machines hold value longer, have higher demand from contractors, and are easier to resell. Rental companies like Saregama Equipment and Metro Rentals report 30% higher utilization rates for Caterpillar machines compared to Komatsu. For rental businesses, that’s a big advantage.

![Which Country Dominates Global Pharmaceutical Production? [Data-Driven Guide 2025]](/uploads/2025/07/thumbnail-which-country-dominates-global-pharmaceutical-production-data-driven-guide.webp)